Late Submission Penalty Lhdn

Penalty as per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

Late submission penalty lhdn. Exchange of information automatic exchange. The following table is the summary of the offences fines penalties for each offence. Real estate gains 1976 ackht 1976.

Long answer if caught by the lhdn s auditor you ll face a penalty ranging from 80 to 300 of the taxable amount. The period prescribed under the income tax act 1967 acp 1967 petroleum income tax act 1967 apcp 1967 and tax act. Bayaran cukai keuntungan harta tanah available in malay language only international.

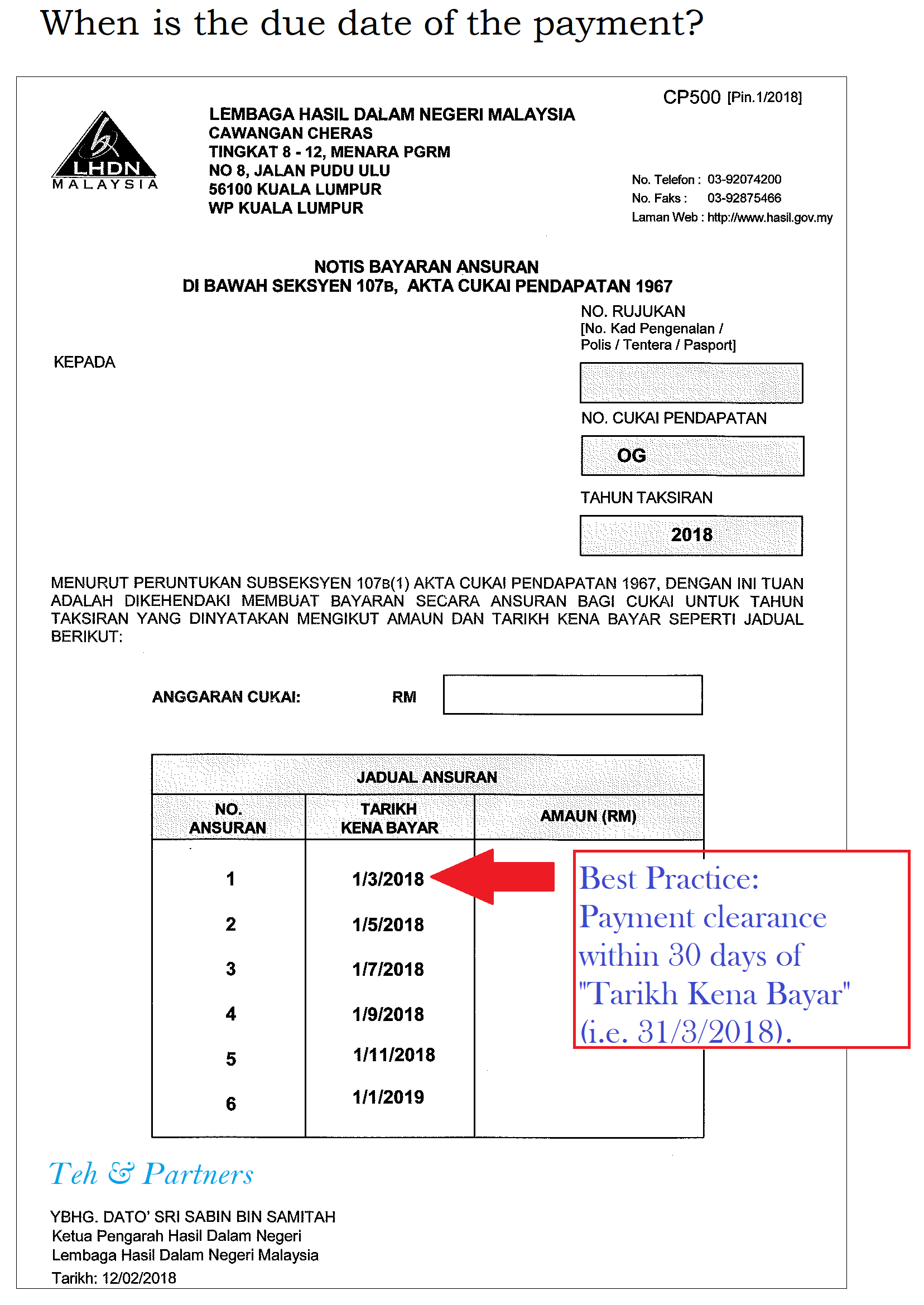

Cancellation of disposal sales transaction. Late payment penalty monthly payments should be remitted to the lhdn by the due dates that is by the 10th day of the following month. If the tax payable and penalty is still outstanding within 60 days from the due date an additional penalty of 5 will be imposed on the tax and penalty outstanding.

Penalty late submission on tax payment lhdn. Taxpayers who are late or fail to submit a return form in. Difference between the estimate submitted and final tax payable.

Imposition of penalties and increases of tax. Posted on september 4 2020 september 4 2020 by admin. For example if your total taxable amount is just rm500 now you have to pay rm1 500 because of the 300 penalty.

Membantu menasihati orang lain dalam penyediaan borang nyata cukai pendapatan menyebabkan terkurang cukai. Penalty for late payment. Tuan diminta menghubungi cawangan yang mengendalikan fail cukai pendapatan tuan atau hasil care line di talian tanpa tol 03 8911 1000 lhdn bagi tindakan pengeluaran cek gantian.

For individual with employment no business income the dateline is 30th april while individual with business income the dateline is 30th june. Failure to remit the instalments on a timely basis will result in an automatic penalty of 10 being imposed on the unpaid amount. Penalty as per income tax act ita 1967 payment of income tax income tax has to be settle by the due date.

Purpose these guidelines explain the imposition of penalties on. Pegangan dan remitan wang oleh pemeroleh available in malay language only shares in real property company rpc procedures for submission of real porperty gains tax form. That s a lot of money people.

Penalty for late payment if the balance of tax payable is not paid by the due date a penalty of 10 will be imposed on the outstanding amount.