Lhdn 2016 Tax Rate

Income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances example 8 amended on 12 07 2017 08 06 2017.

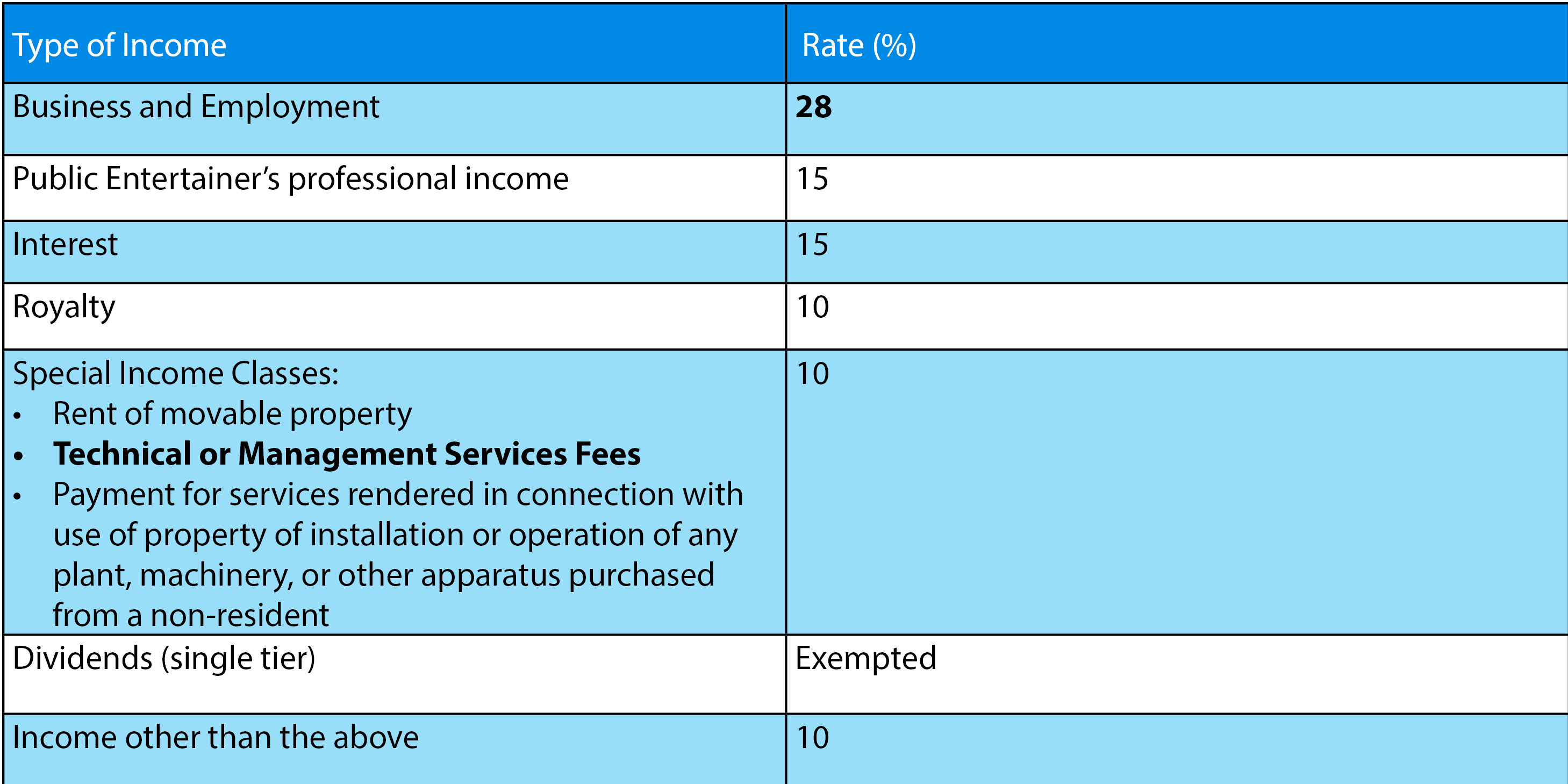

Lhdn 2016 tax rate. On the first 5 000 next 15 000. Tax information record management division tax operation department menara hasil bangi no. Company with paid up capital more than rm2 5 million.

Company with paid up capital not more than rm2 5 million on. Home tax rate of company. Calculations rm rate tax rm 0 5 000.

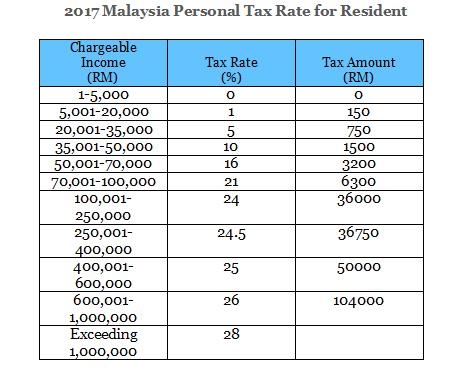

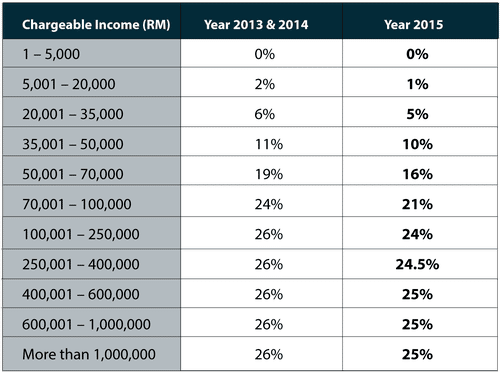

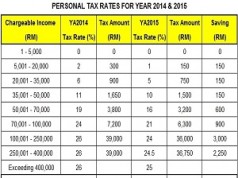

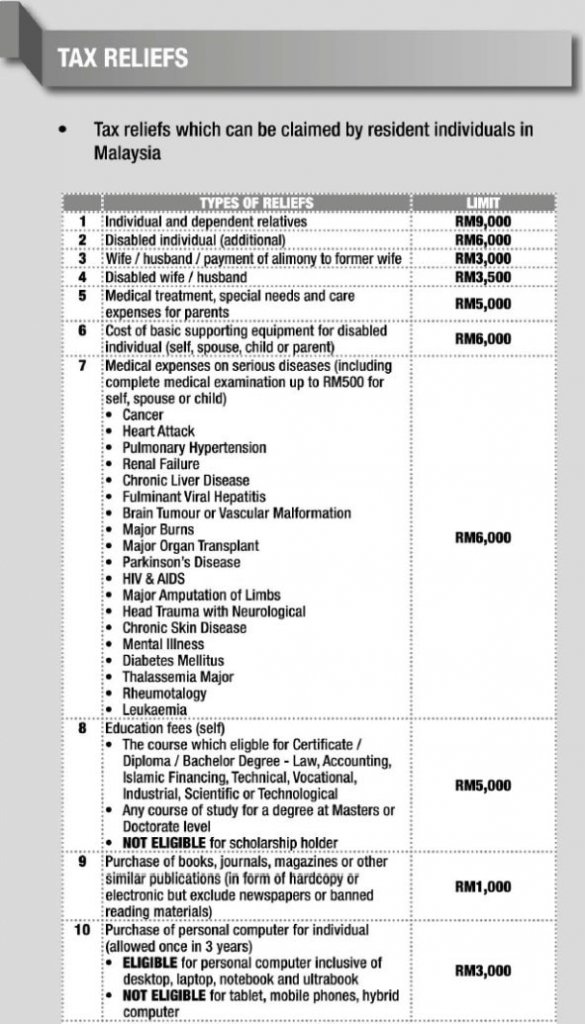

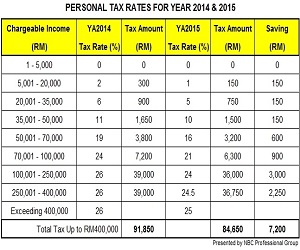

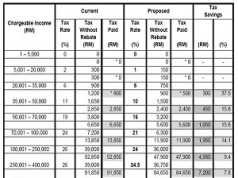

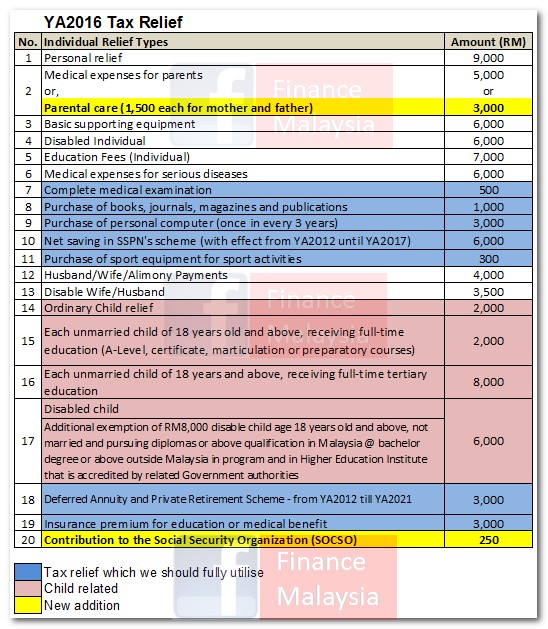

This relief is applicable for year assessment 2013 and 2015 only. Assessment year 2016 tax rates incometax office in of the website home about contact disclaimer sitemap. Based on the tax rate table above rm25 000 would be taxed rm150 on the first rm20 000 and rm250 on the remaining rm5 000 which brings it up to about rm400 in tax.

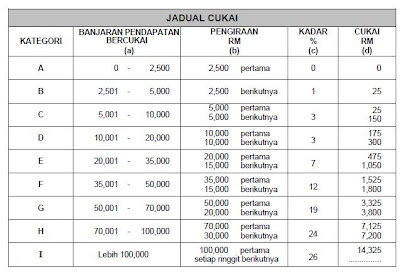

Paying the income tax payable. On the first 2 500. Sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja.

Year assessment 2009 until 2015. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. Claim for reinvestment allowance ra for the qualifying project under schedule 7a income tax act 1967 gross domestic product 1998 2004 industrial production growth rates for manufacturing sector year assessment 2005 2007 industrial productivity rate for manufacturing sector 2008 gdp 2018 available in malay version only.

Computing income tax payable. Study group on asian tax administration and research sgatar commonwealth association of tax administrators cata inter american center of tax administrations ciat organisation for economic co operation and. Jadual average lending rate bank negara malaysia seksyen 140b.

You can check on the tax rate accordingly with your taxable income per annum below. 3 jalan 9 10 seksyen 9 karung berkunci 222 43659 bandar baru bangi selangor. The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates.

Company with paid up capital not more than rm2 5 million on first rm500 000 subsequent balance. Income tax rates 2020 malaysia. The following table illustrates the income tax rate for each taxable income amount for the year 2016 assessment.

Company with paid up capital not more than rm2 5 million.